MyCryptoBank - Cryptobank For Cryptocommunity

About Mycryptobank

MyCryptoBank — is an online bank allowing any client registered in the electronic bank system to make a full range of bank operations, additional operations with cryptocurrency (payment processing, debit cards, credits and cheap investment products, use of cryptoassets as credit security and many others) based on Blockchain technology without visit of department. So, MyCryptoBank provides services of client’s remote access to accounts, products and bank services in order to make banking operations.

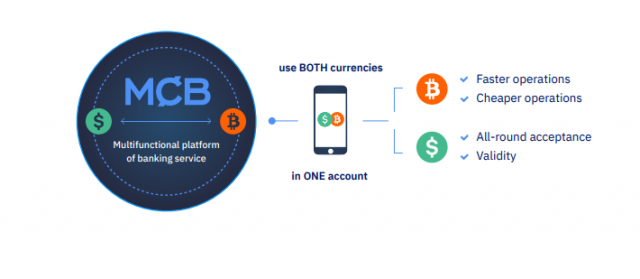

MyCryptoBank offers its clients a multifunctional platform of banking service, which represents a hybrid system combining digital and traditional currencies. The use of digital currencies makes operations faster and cheaper, while traditional currencies guarantee practically all-round acceptance and validity. One account combination allows clients simultaneously using advantages of both types of currencies.

In the modern world countries are divided into 2 camps: supportive cryptocurrencies and institutions try to ban it because of the threat to the economy. And even in those cases, which are faithful to cryptocurrencies, eg Estonia where a license allows to work with acceptable cryptocurrencies, the bank blocks client accounts, which remain in contact with cryptocurrencies. And the problem exists in many countries (Finnish Crypto Risk Of Freak Securities As Banks Refuse To Do Business.

Banks refuse your Crypto Business? Go to court. the Dutch bank refused the account for the cryptocurrency business. Two Major Indian Crypto Exchanges closed. Chilean Bank Order Court for Re-Open Crypto Account Securities). The bank sabotages its implementation process in everyday life, severely disrupts the aforementioned account opening for the company, conducts the ICO, and may also block the company's account at any time. This creates a major problem for cryptocommunity, who wants to buy and sell cryptocurrencies, receive and send funds in fiat money (money from different countries USD, EUR, RUB etc.) for Token purchases while conducting ICO and free further money transfers all around the world without fear of account blocking.

MyCryptoBank is intended to solve this problem. It will become the first bank for cryptocommunity, allowing clients to receive and send funds in cryptocurrencies and fiat money and also exchange between cryptocurrencies and fiat money inside the bank. With MyCryptoBank it will be possible to create deposits, receive loans and credits. The bank will create an infrastructure which will allow setting acquiring and merchants for goods payment for companies and online services. Clients will be able to receive bank cards and with the help of it they will take available funds through any ATM in the world and also pay in shops, restaurants etc.

For client convenience, the bank plans to install ATM and crypto ATM, assisting in making operations on cryptocurrency purchase and cash receipt with minimum fees. In the usual sense, it will be typical bank with the whole range of services but loyal to cryptocurrencies and cryptocommunity. It will give an undeniable advantage over other financial institutions, attract many clients and their funds for creation of bank’s positive liquidity and allow supporting and developing all products of MyCryptoBank.

FinTech Market Analysis

As already mentioned, financial technologies have already moved from hype phase and innovative and new stream status to main stream and absorbed the most part of the economically active population in developed countries. The most part of millenials hardly distinguish FinTech from simple term of finances. Banking, online purchases, trading and other financial operations have been closely associated with internet technologies use.

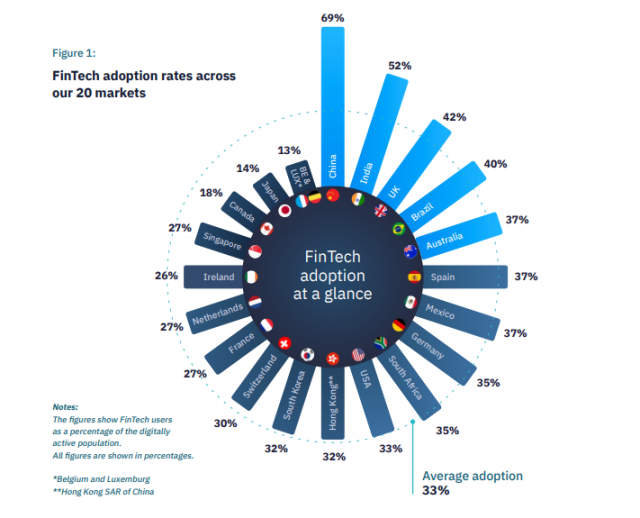

Curiously enough, FinTech found (p.7) its widest expansion both on user quantity and population share in developing markets: China (69% of population use FinTech-products), India (52%) and Brazil (40%). Calculating above mentioned figures, Ernst & Young analyzed all age and social categories of users. However, it’s obvious that percents will be significantly higher if you narrow the survey group to more young people and the economically active population.

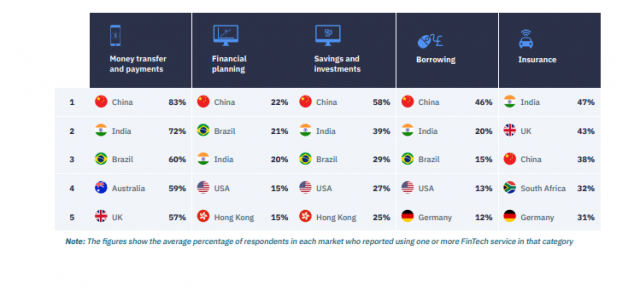

Comparison of the top five markets with the highest FinTech category.

Depending on how many tokens are hold by the users, they obtain following statuses

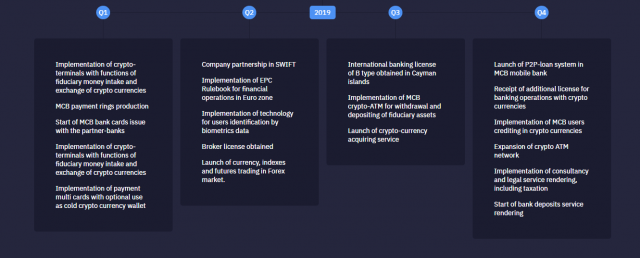

Roadmap

Distribution of Funds

65%: Distributed among the ICO participants

10%: Kept for the project team

3%: Allocated for development of the Bounty campaign

7%: Distributed among partners and experts

15%: Reserve fund

30%: Development and Integration of Blockchain Platform

20%: Marketing and Partner Network Development

20%: Obtaining banking licenses and maintaining the bank liquidity

10%: Development of crypto ATM network with fingerprint identification and face recognition function

10%: Development of innovative products

10%: Infrastructure development

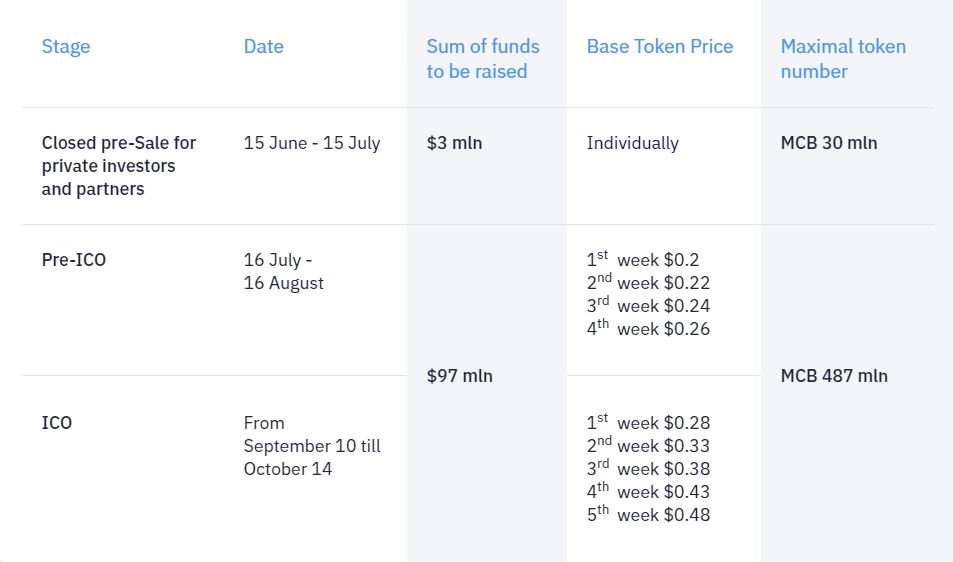

Order and rules for ICO conducting

More Information :

My Bitcointalk Account: jonpanin

Komentar

Posting Komentar